-

Posts

1,169 -

Joined

-

Last visited

Content Type

Profiles

Forums

Blogs

Events

Gallery

Store

Posts posted by Lazorko Saves

-

-

Quote

MacKinnon is guaranteed $1MM on the deal — a $900K salary and $100K signing bonus.

Wow, happy birthday to D-Mac.

-

28 minutes ago, mmc said:

Not exactly, their 2nd and 5th round picks are removed and we get a compensatory pick at the end of the 2nd round, but their pick doesn't convey directly to us

When it comes up, we should ask the Dodgers "who would you pick here" and then pick that guy.

That way it will twist the knife just a tiny bit. A very tiny bit.

-

1 hour ago, gotbeer said:

Where do you get 1.2 billion at? The value of the contract is $700 million.

25% of Dodgers current valuation of $4.8b is $1.2b. It's the minimum value *today* of the 25% ownership option that is being imaged maybe exists. Such an option will have more than $1.2b in value by 2034. See the Nobel Prize winning work by Black and Scholes if you're interested in the oddities of contract option pricing.

I'm just telling you that this 25% ownership theory is way off, financially/mathematically. So is 15%.

Ohtani's not getting 25% ownership for $680m of future payments. Nor 15%. The correct application of option pricing models in those cases would value the Dodgers below the $2.15b that was paid by the current group back in 2012! Not possible!

If such a deal exists, it will be something on the order of 2% to 5% or something in that range for a chunk of his payments after 2034.

-

17 minutes ago, Angels 1961 said:

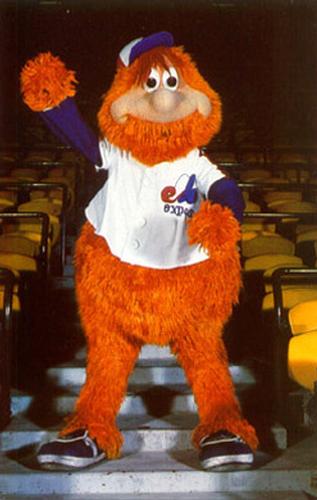

How about Yippei

Youppi?

-

2 minutes ago, gotbeer said:

Actually, at forbes $4.8 billion valuation. $680 million would be 14.16%. You could say future value, but since the deferral doesn't take into consideration any interest, I'm sure the wink wink deal is on current value.

Okay, then you think the Dodgers have just paid Ohtani a heavily front-loaded 10 year deal. $1.202 billion paid in the first year ($2 million salary, plus $1.2 billion ownership asset), 2 million for the next 9 years. No $68 million dollar payments beginning 2034, just the 25% stake.

The value of that deal is $1.22 billion. Current day value. No future discounting required.

You seriously think that's what Ohtani got?

I'm just trying to help ya'll understand that any ownership share will be closer to 2.5% than 25%.

-

7 minutes ago, Pancake Bear said:

But sure, call us idiots.

Regrettably, there is no other word for people who think Shohei got a 20 year call option on a 25% stake of $4.8 billion dollar asset.

It's impossible.

It's only believable if the guy missed a decimal point, and the stake is something like 2.5%.

-

10 minutes ago, Lhalo said:

I think people are saying Ohtani will get a stake in ownership in leu of his deferred payment. You may think it’s ridiculous but don’t forget that Magic Johnson is an owner lol.

It's an MLB contract. It's not voidable or supersedeable. Per collective bargaining. So they're going to have to pay him through 2043 in any case. Sale couldn't be completed until 2043 then.

Magic Johnson bought a 4.5% stake in the Lakers. That's in the range of financially possible.

A 10 year option on a 25% stake locked in at current valuation is way over a billion dollars of present day value. I'm too lazy to do the Black-Scholes calculation on it, but it's way over $700 million, probably on the order of something like double that.

-

What a minute, people think what? Shohei gets his $700 million plus a 25% stake of a team that's currently valued at $4.8 billion. So you think Shohei is actually getting $1.9 billion?

Ya'll bonkers.

Keep in mind, that in 2034 the Dodgers will almost certainly be worth $10 billion or so.

Or do you think Shohei will use the $700 million cash to buy a 25% stake in the year 2043, once he's got all the payouts? By 2043 the Dodgers will likely be worth about $20 billion, but the Dodgers are willing to give him a 25% stake for only $0.7b?

Ya'll need to go back to junior high school math and economics classes.

-

15 minutes ago, greginpsca said:

Wondering if the IRS will have something to say about deferring 68m of his $70 m. After all it is payroll. Before i retired the most i could defer into a retirement account was 15%.

That's tax deferral, which has a flat number cap.

Shohei is not just deferring the taxes on it, he's deferring the receiving of it entirely. Not even the IRS is so evil as to tax you on payroll you haven't received yet.

-

So according to B-R numbers, Arte has paid Shohei just under $40 million in his time with the Angels. Aka, his "cost controlled" years. Doesn't include the fee paid to his Japan team.

Dodgers won't have paid Shohei $40 million until Q2 of 2034.

-

1 minute ago, T.G. said:

I miss the time when we all thought Ohtani was on a plane to Toronto.

Now we know why it wasn't him. At only $2 million a year, he can't afford to fly a Global 5000 anywhere on his own dime.

8 hours round trip x $10k an hour for a G5000 = $80k for the SNA-YYZ round trip.

That's the equivalent of $2400 for someone making $60k a year.

- Amazing Larry and T.G.

-

2

2

-

1 minute ago, T.G. said:

On MLB Trade Rumors...

Passan reported over the weekend it was Ohtani’s idea.

Damn.

It figures. Dodgers would never have thought to offer it, because it's insane and they probably expected Ohtani to be insulted by such an offer.

This confirms it, Ohtani is the most financially illiterate person ever to have a nine figure net worth.

-

Arte paid $30 million to Ohtani (arbitration 2023 salary) before he hit free agency. No World Series, and revenue will drop in the immediate future (reduced advertising, etc.).

Dodgers will pay him $2 million after free agency. Immediate revenue boost.

Dodgers will pay him with inflated money beginning in 2034, after they've won multiple World Series and their revenues/profits have had a decade worth of increases.

The Dodgers have pulled one of the biggest swindles I've ever seen.

-

3 minutes ago, Angels 1961 said:

All Ohtani is doing is putting money away for his retirement in 2034. We should teach all young people to do this. I wonder will he still draw a SSN at 65?

I think it's backwards of this actually. The Dodgers are the ones putting the money away until 2034. They'll almost certainly make a better ROI on it than Ohtani thinks he can, then they'll pay Ohtani later with either a portion of their return. The Dodgers will come out ahead here.

-

Wow, these numbers are crazy.

So my gorilla math says that current cap hit of $46 million on a $68 million payment to be made beginning in 2034 is about a 4.0% interest rate.

I would be very curious what the Dodgers non-deferred offer was. 4.0% seems really low for a decade long rate of return, so either Ohtani is an extremely nervous investor or the Dodgers were way below $46 million a year in a current money/non-deferred offer.

I would argue 8.0% is a very conservative rate of return that Ohtani and his agents should have been demanding. If they did, then it kind of implies the Dodgers (and no one else) offered no more than $31.5 million a year! Not likely.

Bottom line, in my opinion, Ohtani's and his agents really badly here, in spite of the glowing headlines about "biggest team sports contact ever".

-

You missed one scenario:

The Worstest: Angels top the Dodgers offer and go $780 million over 11 years, keeping Ohtani. Ohtani's skills at the plate rapidly and he basically becomes some kind of mix between Joey Gallo and Chris Davis offensively. On the mound, Shohei returns in 2025, but the fastball is topping out at 89-90 and he's posting an ERA above 4.50. He's become the 33 year old version of Jered Weaver.

-

All 7.

- Chuck, HanfordGuy and Swordsman78

-

1

1

-

1

1

-

1

1

-

-

31 minutes ago, Inside Pitch said:

Taking the exchange rate into account -- that would have been like a 12 year 426 million dollar deal.

There's no exchange rate conversion to do, all MLB contracts are paid in US dollars, including the Blue Jays players. Same is even true with NHL contracts.

-

Time for me to go look at JPY-USD forex market, should be a big drop as a lot of Japanese money will be leaving the country to the US to swap out red gear for blue gear.

-

1 minute ago, Second Base said:

Didn't that start with Bobby Bonilla?

Bonilla was pre-cap, so that as purely for cash flow.

The Kovalchuk deal was 17 years for $102 million, when he was 27 years old. The team knew he wasn't going to be playing on into his mid-forties, so the length was pure fiction just to lower the salary cap hit. The NHL voided the contract immediately because it was a clear salary cap circumvention.

-

Just now, Warfarin said:

Nope. The AAV will be considerably less if most of his contract is deferred. I am 100% certain on this.

No....freakin'...way. That is just insane then.

MLB is really so dumb as to have not learned from the NHL and Kovalchuk, which happend all way back in 2010?

Then all big deals are going to look like the Bobby Bonilla contracts.

If this is really how it works, then Perry's got to get on the phone with Yamamoto's agent and start talking about a 25 year deal for $400 million. That's what it's going to take to get him then.

-

7 minutes ago, Warfarin said:

I suspect this will be an issue in future labor contracts, if the Dodgers give him a 10 year, 700 million contract that ends up being like a 25mil AAV deal because he's being mainly paid in like the year 2080.

Wait wait wait. Are ya'll telling me that MLB hasn't closed the Ilya Kovalchuk loophole? That somehow Ohtani's cap hit will be something like $25m? There's no way. They have to have learned from the NHL and the Kovalchuk contract and put that into the luxury tax calculations.

Luxury tax hit has to be $70m a year, regardless of deferrals. Right?

-

I'm not even upset now. I am glad my team is not paying $70m for one player until age 39.

If somehow he would have signed for something like $42m a year or less, I might have been upset that we missed that.

But not upset at all here whatsoever.

.png.994d0bf2808e959b0fc1cd230c27b6eb.png)

The Official Los Angeles Angels 2023-2024 Hot Stove Offseason Thread

in LA Angels | MLB Daily

Posted